Xero offers double-entry accounting, as well as the option to enter journal entries.

The dashboard in Xero offers a summary of current account activity. Xero offers a long list of features including invoicing, expense management, inventory management, and bill payment. Xero is an easy-to-use online accounting application designed for small businesses. Here are a few choices that are particularly well suited for smaller businesses. If you want help tracking assets and liabilities properly, the best solution is to use accounting software.

General ledger accounting is a necessity for your business, no matter its size.

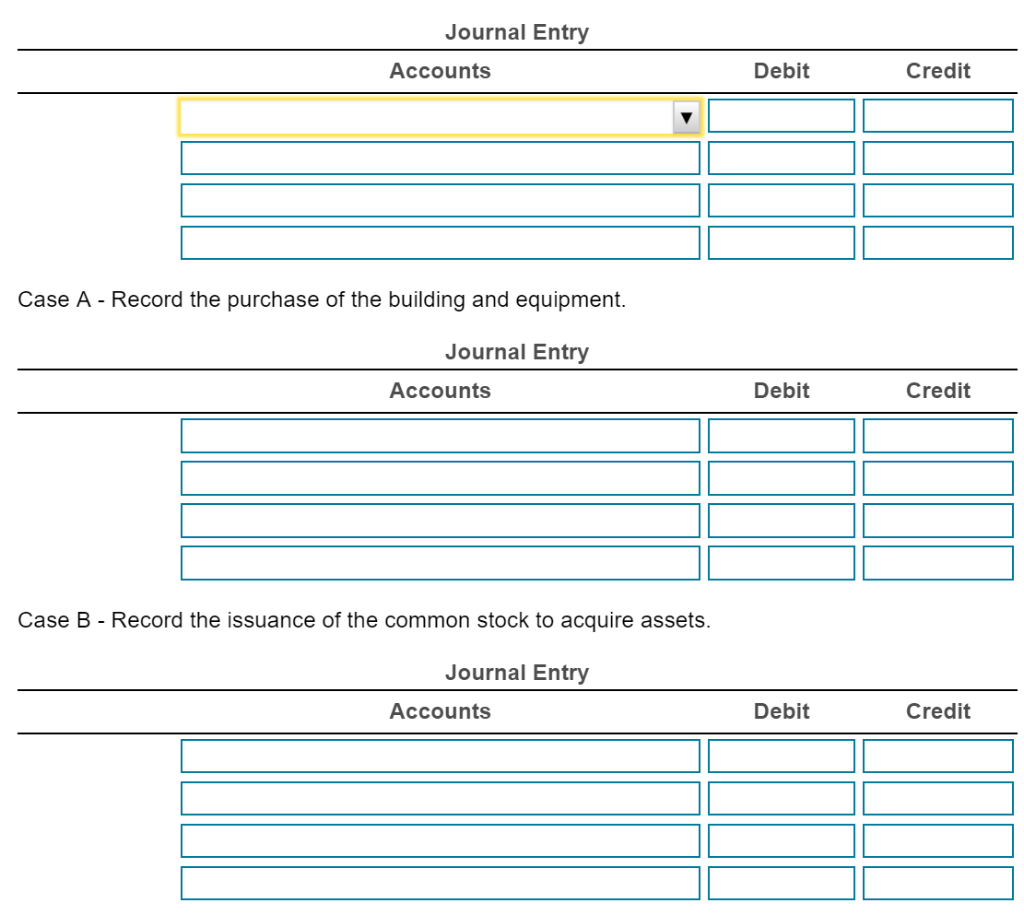

Debit credit accounting exercises software#

Best accounting software to track debits and credits You would debit (reduce) accounts payable, since you’re paying the bill. Here is how you would record these debits and credits in a journal entry: After 7% sales tax, the customer is invoiced for $107.00. Recording a sales transaction is more detailed than many other journal entries because you need to track cost of goods sold as well as any sales tax charged to your customer.įor example, on February 1, your company sells five leather journals at a cost of $20 each. Here are a few examples of common journal entries made during the course of business. When a product is returned, or a discount is givenĮxamples of debits and credits in double-entry accounting Various expense accounts such as rent, utilities, payroll, and office supplies When depositing funds or a customer makes a payment If you’re unsure when to debit and when to credit an account, check out our t-chart below. A credit is always entered on the right side of a journal entry. Debits are always entered on the left side of a journal entry.Ĭredits: A credit is an accounting transaction that increases a liability account such as loans payable, or an equity account such as capital. Revenue: Revenue is the money your business is paid for the sale of products and servicesĮxpenses: Expenses are considered the cost of doing business and include things such as office supplies, insurance, rent, payroll expenses, and postageĬapital/Owner Equity: The Capital/Owner Equity account represents your financial interest in the businessĭebits: A debit is an accounting transaction that increases either an asset account like cash or an expense account like utility expense. Liabilities: Liabilities include things you owe such as accounts payable, notes payable, and bank loans Debits are always on the left side of the entry, while credits are always on the right side, and your debits and credits should always equal each other in order for your accounts to remain in balance.įor instance, if we were to record a $250 payment received on account from a customer, the journal entry for debits and credits would look like this:Īssets: Assets are things you own such as cash, accounts receivable, bank accounts, furniture, and computers In double-entry accounting, any transaction recorded involves at least two accounts, with one account debited while the other is credited.

You may even be wondering why they’re even necessary.ĭebits and credits are used to ensure that you’re adhering to the accounting equation, which is: What are debits and credits?Īs a business owner, you may find yourself struggling with when to use a debit and credit in accounting. This is particularly important for bookkeepers and accountants using double-entry accounting.ĭebits and credits are the true backbone of accounting, as any transaction recorded in a ledger, whether it’s hand-written or in your accounting software, needs to have a debit entry and a credit entry.īut how do you know when to debit an account, and when to credit an account? The following basic accounting rules will guide you. We’ll help guide you through the process, and give you a handy reference chart to use.ĭebits and credits are two of the most important accounting terms you need to understand. If you’re using double-entry accounting, you need to know when to debit and when to credit your accounts.

0 kommentar(er)

0 kommentar(er)